There are plenty of surveys to understand your customers: qualification, satisfaction (CSAT), NPS, CES, onboarding, and product/market fit.

But using them correctly isn’t as easy as it looks. A small mistake and your dataset becomes irrelevant.

If you do not ask the right questions, your survey will be useless. But that’s not enough to ask the right questions. You also need to ask them at the right time.

Qualification Surveys

You need to sell your product to right-fit customers. In order to do that, you need to know who your site visitors are. HotJar and RightMessage both offer surveys to get to know your site visitors better. You do a survey with one or more multiple-choice questions and this way you know more about them.

For example, you can ask about the role they have in their company. From this simple question, you will be able to adjust your sales and marketing to target them better.

Customer Satisfaction Score

Customer Satisfaction Score (CSAT) is a very simple way to measure satisfaction. You ask your customers how satisfied they are and the answer is either good, neutral, or bad. You can have a bigger scale, but it won’t make the results more accurate because of cultural bias.

But it’s a very vague survey so you can’t really ask your customers about their satisfaction about the whole relationship with your business, it would be meaningless. You need to use CSAT in specific places:

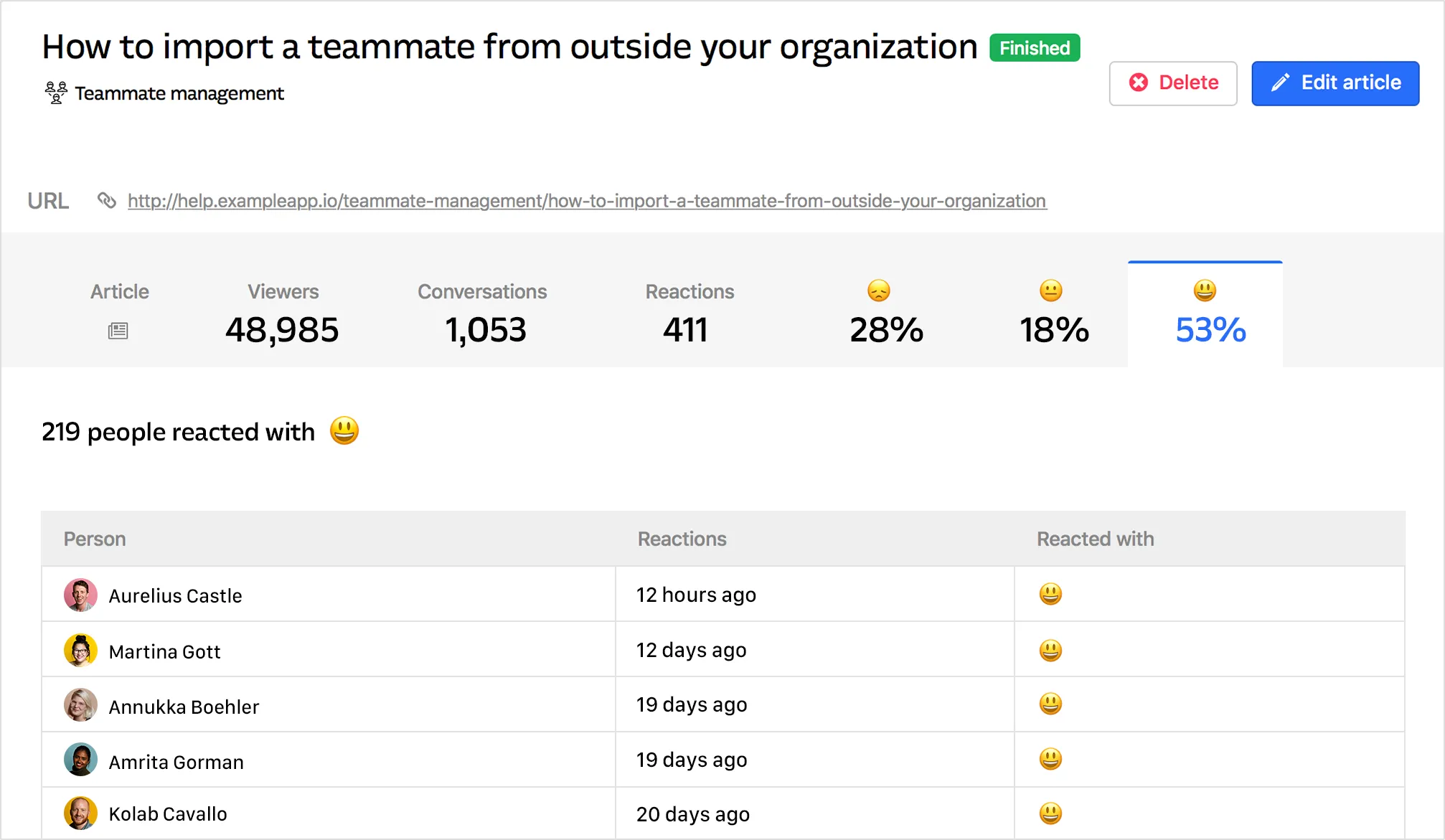

- Knowledge Base: At the end of each article, place a survey to ask your customers if they are satisfied with the article

- Support: Ask their satisfaction with the support when the ticket they opened has been closed

- Public Roadmap: Add the ability to upvote/downvote feature requests on your public roadmap

- Changelog: At the end of each article, ask your customers if they are satisfied with the latest release

While it won’t give you much information, it’s enough to know what can be improved and start tweaking and re-prioritize.

Be sure to understand that the data collected doesn’t represent satisfaction in the long-term relationship between the customers and your business.

Net Promoter Score

Net Promoter Score (NPS) is a type of survey that is widely used to measure customer loyalty. But it has been highly criticized. NPS often fails to predict loyalty and to have to choose between 11 different scores is a hard choice to make for customers resulting in some inaccuracy.

How to make it more accurate?

In addition to the traditional question “How likely are you to recommend the product to a friend?” you absolutely need a qualitative question to go beyond a simple number and better understand your customers. It takes the form of the following open-ended question “What is the most important reason for your score?”.

Going more in-depth than the three NPS segments – detractors, passives, promoters – will also help you better understand customer behavior. There are many metrics you can use, but it’s up to you to see what works best: pricing plan, customer feedback, user activity, etc.

Follow-up

Although promoters are likely to refer you to a friend, they probably won’t. Follow-up with your promoters and actively seek their help:

- Ask them to join your affiliate program if you have one. They will more likely refer you if they have a financial gain.

- They could also write customer reviews.

- Marketing can also follow-up so they can publish case studies, testimonials, or ask promoters to talk at events.

Conclusion: NPS isn’t accurate enough to use it by itself so you will have to complement it with other metrics. But the real benefits also require a lot of work. Following-up takes time, but the resulting growth is going to be worth it.

Onboarding Surveys

Onboarding is one of the most important things to do right if you want your SaaS company to flourish. But it can be hard to find what to do to improve it. Listening to your customers is once again the best strategy to follow.

Customer Effort Score

Customer Effort Score (CES) helps you measure how much effort was required by your customers to get their problem solved. Post-onboarding, it measures the difficulty of your onboarding process. You can formulate the question that way:

“How easy was it for you to get started with [Product Name]?”

CES is a strong predictor of satisfaction. If the majority of your customers don’t find the onboarding experience easy or very easy, you have a lot of work to do.

Include open-ended questions

You need an open-ended question in order to try to understand why customers may have a hard time with the onboarding. There are also other questions you can ask to get even more insights.

What made you decide to try/buy? You understand what triggers the buying decision for your customers which will make it easier for sales and marketing to focus on the right strategy.

What challenge are we not solving for you that we could be? That’s a great question to be able to more accurately define your product roadmap. It also allows you to clear up any confusion customers may have had during the onboarding.

Don’t send an NPS survey right away

I have seen this too many times. I get asked to fill out an NPS survey a small few days after I signed up. The chance I am already a promoter is very slim.

You can’t ask freshly onboarded customers to fill out an NPS survey. They haven’t had the time to recommend your product, and the results are going to be useless. As stated above, NPS isn’t a very accurate measurement, so you need to be extra careful and use it at the right time.

Conclusion : Sending out a CES survey with a few open-ended questions at the end of your onboarding emails is a great way to find out the performance of your onboarding process. Because you have feedback right after the onboarding, you can fix issues customers may have had so that when it is time to renew, problems will be gone and they won’t churn.

Product/Market Fit Surveys

Because NPS isn’t very accurate, we have to find ways to complement it with other data. Product/market fit surveys are a more precise way to get to know the satisfaction of your customers and will be a great addition to NPS surveys.

What is product/market fit

Here’s the definition of product/market fit as defined by Marc Andreessen, famous Silicon Valley investor.

Product/market fit means being in a good market with a product that can satisfy that market.

Sounds like the definition of Customer Success to me except formulated by an investor. So naturally, asking questions to your customers is going to be the best way to find out if you have achieved product/market fit or not.

What questions to ask

The product/market fit survey was created by Sean Ellis, founder & CEO of GrowthHackers. Sean designed the survey to understand what relationship the customers have with your product.

Here is the survey application from Sean

Results

If you don’t have enough customers, you might not be able to run this survey. But you don’t need a lot of responses for the results to be accurate. Only 40-50 responses are enough. Of course, more is going to be better.

The most crucial question in the survey is “How disappointed would you be if you could no longer use this product?“. If more than 40% of your customers would be very disappointed if they could no longer use your product, you have achieved product/market fit.

The other questions are also important and will allow you to get a significant amount of qualitative data. With it, you are going to be able to analyze and find insights about your customers that will allow you to improve the whole customer experience.

Conclusion : This survey has more questions than surveys like NPS so to be sure to do it correctly, use an easy-to-use survey tool and start with the template Sean designed. It’s a great way to find out if you achieved product/market fit and you get plenty of qualitative data in the process which is essential in order to improve Customer Success.

Cancellation Surveys

Churn is an important KPI, and SaaS businesses should try to reduce it as much as possible. The best way to understand why your customers are churning is to ask them.

Make it mandatory

The amount of feedback you will get from an optional cancellation survey is going to be pretty thin. That’s why it’s preferable to make it mandatory.

Expect a lot of useless feedback as some customers are going to be angry they have to do anything more than clicking a button, but those are unlikely to return anyway.

To maximize your chances of getting valuable feedback, add a multi-choice question in addition to an open-ended question. This way you will at least have a general idea of why customers cancel. Is it because of bugs, performance, competitors, support, etc?

Insights you can learn

By tracking the answers over time, you will be able to get more insights about common questions.

- Which competitors cost you the most money

- Is your pricing right

- Are the improvements you made to the infrastructure being fruitful

For example, Cashboard learned that many of their users were fine with the free plan which hurt their business.

The overwhelming thing I realized with this feedback is that free is our biggest competition. I used to think the more well-known services were our competition. I was wrong.

Removing the free plan and making a competitive paid plan helped them reduce cancellations.

Prevent cancellation

Cancellation surveys will help you get more insights, but don’t think you can win them back after they have churned. They have made up their mind, maybe already tried out a competitor, and switched to it. Convincing them to come back after they canceled is a very time-consuming effort with a low ROI.

Instead, try to prevent the cancellation by offering them an interesting option. Maybe it’s a downgrade, a discount, training, or just speaking to someone.

If they don’t cancel and choose one of the options you offered them, it’s still not the end of the effort. If you do nothing afterward, they will cancel. You need to improve the relationship they have with your business.

Avoid bad-fit customers

Cancellation surveys are yet another way to get valuable feedback from your customers. You can learn valuable lessons from them. And by offering them an option before cancellation, you can make them stick around more.

With that said, the best strategy to reduce cancellation is to filter out bad-fit customers as much as possible. Offering incentives for bad-fit customers to stay is a disastrous strategy. They will still be generally unsatisfied and will cost more time and money for your company than right-fit customers.

The Best Tools To Conduct Customer Surveys

Start with a free tool

There are many apps for surveys but they might not fit the budget of every company. I personally use Airtable and I think it’s great to start with.

Segmentation & in-app widgets

At some point though, you need better tools. When your customer base grows, segmentation will become a requirement to keep up with data.

You will also need tools with better UX. Embedding surveys directly into your SaaS makes it very convenient to ask questions to your customers.

I recommend Refiner because it combines in-app widgets with a powerful segmentation feature.

Cancellation flow

You can use generic solutions to add a survey during cancellation or you can also use solutions built exactly for that purpose.

Churnkey is an application specifically made to create a better cancellation flow and analyze data collected from the survey to find the answers you are looking for to reduce churn.

Customer Survey Best Practices (Dos and Don’ts)

According to a study from Zendesk, 21% of respondents found surveys too time-consuming, 16% found them annoying, 16% found some questions too personal, and 12% found questionnaires too long.

Applying good practices is essential to avoid ending up with poor quality data and to obtain a satisfactory response rate.

- Keep your surveys short. The longer it is, the fewer respondents you will get – which might be reasonable for specific needs.

- Share the survey with some people to test its effectiveness and improve it before sending it to your customers or prospects.

- Make sure all your questions are needed. If your first testers are doubtful about its usefulness, improve the question or its description.

- Your questions should be clear and direct. Respondents should not think too long to answer them.

- Avoid cognitive bias. Do not put your opinion in the questions or answers.

- Use your respondents’ jargon. Participate in the communities they are part of to better understand their language.

- Avoid binary responses (yes / no) and use a scale instead (not at all / a little / moderately / a lot / extremely).

- Keep the number of answers to your multiple-choice questions reasonable. The more choices there are, the harder it will be for your respondents to choose one.

- Contact clients with poor ratings. National Australia Group has improved its resolution rate by 31% using this technique.

- Avoid grids and matrices. One question at a time to keep it simple for your customers to complete.

- Don’t put absolutes in your questions (e.g. do you always use this feature?).

- Don’t ask your respondents to answer questions containing several things (ex: how do you find our product and our customer service?).

- Save personal questions for the end.

- If possible, collect answers even if the respondent does not complete the questionnaire.

- You can use a motivation to get more respondents but the reward must be related to your audience so as not to pollute the data (ex: a figurine to win for a geek audience; an Amazon gift certificate would be too vague).

By far, the best thing you can do is create a process to analyze results efficiently and have automation in place to reduce manual work.

Put a process and automations in place early and you will get ahead of everyone else.

Conclusion

Keep in mind that you shouldn’t overburden your customers with too many surveys. You have to find the right balance between your need for information to improve the relationship with your customers and the point where too many surveys will degrade the relationship. To recap, here are the right times to ask for feedback:

- Before they become customers

- After an interaction with the support or content (knowledge base, changelog, public roadmap)

- At the end of your onboarding email sequence

- Before cancellation

For NPS and product/market fit surveys, it shouldn’t be right after the onboarding. Send those surveys after a little while. Wait a couple of weeks or after the first renewal if customers pay monthly. Also, you have to repeat them regularly – for example, every six months – to have up-to-date information and see the evolution to spot trends.

Finally, don’t forget to follow-up with customers that participated in your surveys to make sure they are aware of your fixes. A personalized thank you email will improve your relationship with those customers, and they will be more inclined to leave feedback in the future as they know you are listening.